EV news

Where EV batteries go to die – and be reborn

In a sleepy, south-western English town, an extraordinary process is in motion that holds promise to improve not only the future of electric vehicles but also how we cope with their environmental burden. At a recycling company named Altilium, old EV batteries are shredded, pulverized and ground into a fine, dark powder known as “black mass.” The powder, which may not look like much, is a treasure trove of minerals like lithium, nickel, cobalt and graphite — all of which are essential components of new batteries. The facility’s job is to pull out these materials and recycle them, allowing spent batteries to reincarnate.

As the world shifts further toward electrification, the demand for electric vehicles and the batteries that power them has skyrocketed. Almost one in five cars sold around the world last year was electric, according to the International Energy Agency. However, this expansion has come with a major caveat: obtaining the materials necessary to make these batteries is both environmentally and ethically fraught. Countries including Indonesia and the Democratic Republic of Congo dominate the supply of metals such as nickel and cobalt, but mining operations there have long been under the stain of human rights abuses.

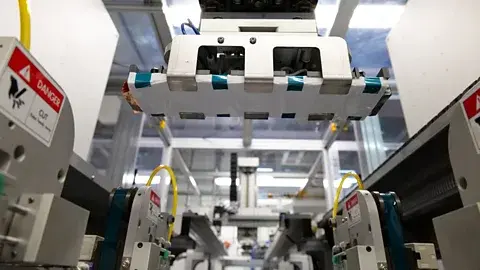

With demand only to continue to grow, the need to identify alternative sources has intensified, and recycling has become a critical part of the solution. But recycling batteries is not an easy business. The materials inside are tightly packed and often toxic, which makes it hard to separate and recover them safely. Altilium thinks it has a viable path forward. In its lab, tubes of bright liquids flow through glass tubes as techs meticulously fish metals from the black mass. It’s a fragile and highly specialized process, and one that the company is scaling up now.

Their space in Tavistock started as an empty shed in 2022, but has developed into a working lab that is getting ready to deliver recycled materials for battery manufacturers. The company is one of a small but growing set of innovators around the world that are trying to close the loop on EV battery production — converting old, spent cells into raw materials for new ones.

Battery recycling is not only an environmental issue — it’s increasingly an economic and geopolitical concern. As traditional sources of critical minerals face increasing unreliability, nations around the world are recognizing the strategic value of domestic recycling capabilities. Rather than sending used batteries overseas to be processed under suspect environmental and labor standards, Altilium wants to do so closer to home. This keeps the materials and the value they create domestic.

Their cheaper, less polluting technique is a variation on a process known as hydrometallurgy, in contrast to an older high-heat technique known as pyrometallurgy. Altilium can isolate graphite by soaking black mass in acid, to be subsequently cleaned and reused. The rest of the solution is a cocktail of metals. By varying the acidity and using a series of chemical extractions, the team can recover nickel, cobalt, and manganese separately — all of which can be customized to what modern battery makers require.

The flexibility afforded by this approach is one its biggest advantages. As companies strive for greater performance and lower costs, battery chemistries are advancing rapidly. Altilium’s system can respond to such changes by extracting and blending certain metals as necessary. It’s a method that could develop a dependable, closed-loop solution for batteries in the UK.

Other companies are moving into the recycling space as well. In the U.S., companies such as Redwood Materials and Li-Cycle have established major operations here, aided by government incentives such as the Inflation Reduction Act. Europe, too, is getting in the act, with new regulations that will soon require stronger recycling efficiency and higher recovered content in new batteries. But even with this increasing interest, most experts say the battery recycling sector remains in its infancy.

The stakes are high. If it works, copper recycling on a widespread industrial scale could sharply cut our dependence on mining, which damages ecosystems and has social costs, too. By 2040, some researchers predict that more than half the demand for key battery metals including lithium and nickel could come from recycling. And in four to six years, recycling could provide as much as 40% of the raw materials used in new EV batteries.”

Altilium says it can dramatically reduce costs, up to 20% over materials extracted using mining methods, simply by scaling up its process. And, with the capacity to process 150,000 EV batteries per year, it is trying to stand at the forefront of a quickly moving industry.

Ultimately, battery recycling is not only about rescuing the planet. It is about getting control of the materials and infrastructure necessary to fuel the economies of the future. And as global tensions and trade disruptions increase uncertainty over the availability of resources, nations with robust systems for recycling their own waste will have a clear competitive advantage. For the UK, and for the world, it could mean not only cleaner energy — but also a more stable and self-sufficient course ahead.

Article By

Sourabh Gupta

Blog

The Tata Sierra EV: The Return of a Legend, This Time Electric

So, if you’ve been around for a while, you probably remember the Tata Sierra, right? It was one of those iconic cars from the 90s — rugged, bold, and perfect for anyone who loved hitting the road. Well, guess what? Tata Motors is bringing back the Sierra in 2025 or 2026, but this time, it will be electric. That’s right — the Tata Sierra EV is coming, and people are buzzing with excitement about it.

If you loved the Sierra back in the day, you’ll be even more excited about its electric makeover. This isn’t just a revamped version of the old model; it’s a whole new take on an iconic vehicle, packed with all the benefits of modern electric technology. Let’s dive into what makes the Sierra EV such a big deal.

What’s Special About the Tata Sierra EV?

1. The Classic Look, Now with Electric Power

The original Tata Sierra was renowned for its rugged, adventure-ready design, and from what we know so far, the Sierra EV is expected to retain that classic, bold look. The tough exterior, spacious interior, and high ground clearance will still be there, but the electric twist means it’s going to be smoother and more environmentally friendly.

We can expect the Sierra EV to have that same adventurous vibe while incorporating all the modern features that come with electric mobility. Whether you’re heading to the mountains for a weekend trip or just running errands in the city, the Sierra EV will handle it with style and ease.

2. Range That Makes It Practical for Long Drives

When it comes to electric vehicles, the range is always a big question. Luckily, Tata is working hard to make sure the Sierra EV won’t leave you stuck looking for a charging point every 100 km. Early reports suggest that the Sierra EV will likely have a range of 400 km or more on a single charge. This means you can enjoy those long drives without constantly worrying about where the next charging station is.

Plus, with fast-charging capabilities, you won’t have to waste hours waiting for the battery to fill up. It’s all about making the EV experience as convenient and hassle-free as possible.

3. Packed with Tech and Features

Now, we all love a car that’s not just about performance but also about comfort and convenience. The Sierra EV is expected to be loaded with all the tech features that make modern driving easier and more enjoyable.

We’re talking about smart navigation, driver assistance features, touchscreen infotainment systems, and even wireless charging. And since the Sierra EV will be electric, it’ll be packed with all those cool features we’ve come to expect from electric cars — like regenerative braking, smart battery management, and more.

Why the Tata Sierra EV Will Appeal to You

So, why should you be excited about the Sierra EV? Here’s the thing: Tata is making electric vehicles that aren’t just eco-friendly; they’re also practical and affordable.

The Sierra EV combines the ruggedness of the original Sierra with all the benefits of driving electric. Whether you’re someone who loves adventure, a family who needs extra space, or just someone looking for a solid, eco-friendly ride, the Sierra EV is set to tick all the right boxes.

What Does This Mean for the Electric Car Market?

The Sierra EV isn’t just a cool new car; it’s a part of the bigger picture for Tata Motors. The company is fully invested in the electric vehicle market, and the Sierra EV is one of the first in what will likely be a long line of affordable, stylish electric cars.

With more and more people in India looking for sustainable alternatives to petrol and diesel, the Sierra EV will offer an affordable electric option that doesn’t compromise on performance, space, or style. As the government pushes for greener mobility, Tata is paving the way for the future of electric SUVs in India.

What Can We Expect from Tata in the Future?

The Sierra EV is just one of many electric vehicles Tata has in the pipeline. We’ve already seen the success of the Nexon EV, and now Tata is ready to push the envelope even further. The Sierra EV will likely set the tone for what’s to come in Tata’s electric SUV lineup.

If the Sierra EV is anything like the Nexon EV, we can expect Tata to keep improving and making electric vehicles that are affordable, practical, and full of modern features.

The Future of the Tata Sierra EV Looks Bright

We’re still a few years away from the official launch of the Sierra EV, but the excitement surrounding this electric SUV is already palpable. With its rugged design, impressive range, and smart features, the Sierra EV is going to be a real competitor in the electric SUV market.

The Tata Sierra EV promises to be more than just a cool electric car; it’s part of a bigger movement toward greener, more sustainable driving. For anyone looking for a reliable, affordable electric SUV, the Sierra EV could very well be the car that leads the charge.

Article By

Sourabh Gupta

Blog

Suzuki Access EV: A New Electric Scooter Set to Compete with the Honda Activa Electric

Suzuki Enters the Electric Scooter Market with the Access EV

Suzuki, a brand renowned for its reliable and fuel-efficient motorcycles and scooters, is now entering the world of electric mobility with its upcoming Suzuki Access EV. Expected to launch in 2025, this electric scooter is poised to become a significant player in India’s rapidly growing electric two-wheeler market. With the rise in demand for eco-friendly transportation, Suzuki aims to tap into the shift toward electric mobility with a scooter that combines familiarity, affordability, and modern electric technology.

India’s electric scooter market is heating up, with strong contenders like the Honda Activa Electric also making their debut. The Suzuki Access EV has big shoes to fill, but with its established reputation in the two-wheeler segment, Suzuki is well-equipped to make its mark.

Key Features of the Suzuki Access EV

1. Sleek Design and Comfort

The Suzuki Access EV will retain the classic design elements that made the Access 125 one of India’s most popular scooters, while incorporating sleek, modern changes suitable for the electric age. Expect a design that maintains the comfort and ease of use for which the Access series is known, but with enhancements to accommodate electric powertrain components.

The Access EV will come with a well-designed, comfortable seat, spacious footboard, and ergonomic riding posture, ensuring that it’s just as comfortable for long-distance commutes as it is for short city rides.

2. Battery and Range

One of the biggest concerns for any potential electric vehicle buyer is the range. The Suzuki Access EV is expected to come with a high-capacity lithium-ion battery that offers a respectable range of 80 to 100 km on a single charge. For daily city commuters, this range should be more than sufficient, offering the convenience of not needing to charge the scooter every day.

The Access EV will also feature quick charging capabilities, so riders can spend less time plugged into a charging point and more time on the road. Suzuki aims to make it as convenient as possible for users, whether they’re commuting or running errands.

3. Smart Features and Technology

In addition to its design and range, the Suzuki Access EV will come with a range of smart features to enhance the rider experience. Expect connectivity options that allow you to pair your phone with the scooter for features like real-time vehicle tracking, remote diagnostics, and battery status updates. LED lights, digital instrument clusters, and regenerative braking systems will also be part of the package, offering a smooth and high-tech riding experience.

How the Suzuki Access EV Will Compete with the Honda Activa Electric

The competition in the electric scooter segment is heating up with Honda’s Activa Electric, which is expected to launch around the same time as the Suzuki Access EV. Both brands have loyal customer bases, and their electric scooters will likely appeal to different segments of the market.

While the Honda Activa has been the undisputed leader in India’s scooter market, Suzuki brings a different set of strengths to the table. The Access EV will likely be priced competitively, giving it a strong chance of becoming a popular choice for those who want the reliability of Suzuki but are also looking for something environmentally friendly and cost-effective.

In terms of performance, both the Access EV and Activa Electric will be aiming for similar performance benchmarks, including good battery life and reliable city range. However, Suzuki’s reputation for durable scooters, combined with the added benefit of an electric motor, could give the Access EV an edge in terms of customer loyalty.

The Impact of Suzuki Access EV on the Electric Scooter Market

As the electric vehicle market in India continues to grow, the introduction of the Suzuki Access EV is a significant step forward. With government incentives for electric vehicles and growing consumer interest in eco-friendly commuting options, electric scooters are becoming a mainstream choice for many people.

The Suzuki Access EV is expected to be a game-changer in making electric scooters more accessible, affordable, and practical for the everyday commuter. By focusing on a user-friendly design, affordable pricing, and efficient battery technology, the Access EV will appeal to a wide range of customers, from those making the transition from petrol scooters to those buying their first electric vehicle.

The Future of Electric Scooters in India

The Suzuki Access EV marks a bold new step for the brand as it enters the growing world of electric mobility. With its solid reputation, affordable pricing, and smart features, the Access EV has the potential to be a strong competitor in the market alongside other popular electric scooters like the Honda Activa Electric.

As 2025 draws closer, we’ll be seeing more affordable electric options like the Access EV, which will make cleaner, greener transportation even more accessible for all. It’s an exciting time for the Indian electric vehicle market, and the Suzuki Access EV is ready to be a part of the future of eco-friendly commuting.

Ev battery

Mahindra Expands EV Portfolio with the BE 07: A New Era of Electric Mobility

Mahindra’s New Electric SUV: The BE 07 is Here to Make a Splash

Mahindra’s been making some big moves lately, and if you’re a fan of SUVs, you’re going to want to pay attention. The BE 07, Mahindra’s upcoming electric SUV, is creating a lot of buzz in the auto world. Expected to roll out in 2025 or 2026, this electric ride is set to change how we think about electric vehicles (EVs) in India.

We all know Mahindra is famous for its tough, reliable SUVs. The BE 07 will be no different, but it’s got a twist — it’s electric. So, whether you’re looking for an eco-friendly car that still packs a punch or you’re just tired of rising fuel prices, this electric SUV might be exactly what you’ve been waiting for.

Why the BE 07 is Such a Big Deal

The BE 07 is more than just a regular SUV — it’s electric, which means it’s a step forward in Mahindra’s push to make green vehicles the norm. Here’s why people are so excited about it:

1. A Fresh, Modern Look

We all know Mahindra is famous for making rugged SUVs, and the BE 07 keeps that vibe alive. But it’s also got a more modern look that screams future-ready. With sleek lines and a sporty design, it’s got that futuristic appeal, but with all the muscle you’d expect from an SUV.

Whether you’re using it for city drives or heading out on a road trip, the BE 07 will stand out wherever you go.

2. Great Range for Long Drives

One of the things people are most worried about with electric cars is range anxiety — basically, how far can you go before needing a charge? Mahindra is addressing this with the BE 07, which is expected to give you a solid 400+ km on a full charge. That means you can take it on longer trips without the stress of constantly needing to find a charging station. Whether it’s a weekend getaway or a daily commute, this car’s range is more than enough.

And with fast-charging capabilities, you won’t be stuck waiting hours for a charge. Quick and efficient charging will make long drives a breeze.

Tech and Features: It’s Got Everything You Need

Electric cars are all about smart technology, and the BE 07 delivers. The car comes with all the modern features you’d expect from a high-end SUV, but with an electric twist. Expect a huge touchscreen infotainment system, smart connectivity, and advanced driver-assistance features to make your driving experience as smooth as possible.

3. Smart Features for a Smooth Drive

If you’re someone who loves having the latest gadgets in your car, the BE 07 will make you happy. It’ll have features like adaptive cruise control, lane-keeping assist, and emergency braking. These features not only make driving safer but also less stressful, especially on highways or during long drives.

The infotainment system will keep you connected to your music, calls, and navigation, so you’re never without what you need. Plus, all of this tech will be integrated into the car seamlessly, keeping everything easy to use.

Why It’s the Right Time for an Electric SUV

If you’ve been thinking about switching to electric, the BE 07 might just be the right moment. As fuel prices continue to climb, the cost of petrol and diesel is hitting us hard. But with electric vehicles, you’re looking at a much cheaper, more sustainable way to drive.

Plus, government incentives are making it easier than ever to buy an electric car. With affordable pricing and low charging costs, the BE 07 makes going green more accessible than ever before.

Who’s the BE 07 Perfect For?

This car is perfect for families, young professionals, or adventure lovers who want a car that’s tough, eco-friendly, and packed with features. If you love the idea of owning an electric SUV that’s both stylish and practical, the BE 07 is going to be a great fit. It’s spacious enough for your family, but with the kind of performance and luxury that will make every drive a pleasure.

What’s Next for Mahindra?

The BE 07 is just one of the many electric cars Mahindra plans to release. As the company continues to expand its EV portfolio, we can expect even more exciting models in the coming years. The BE 07 is just the beginning of Mahindra’s mission to revolutionize the electric vehicle market in India.

With Mahindra’s growing focus on electric mobility, the future of sustainable transportation in India is looking brighter every day. So, if you’ve been considering switching to an electric car, the BE 07 is worth keeping an eye on.

The Future of Driving Is Electric

The Mahindra BE 07 is shaping up to be an exciting, affordable, and eco-friendly option for anyone looking for an electric SUV. With great design, amazing tech, and a reliable range, it’s clear that Mahindra is stepping up its game when it comes to electric mobility.

If you’ve been thinking about making the switch to electric, the BE 07 could be the perfect vehicle for you. It’s affordable, practical, and it’s got everything you need to drive into a more sustainable future.

Article By

Sourabh Gupta

-

Blog5 months ago

Blog5 months agoTop Electric Cars in India Under ₹5 Lakhs – Budget-Friendly EVs for Diwali 2025

-

Blog6 months ago

Blog6 months agoTata Sierra EV 2025 Launch: Price in India, Specifications & First Look

-

Blog1 year ago

Blog1 year agoMahindra BE 6 An Intense Move toward the Fate of Electric Versatility

-

Blog1 year ago

Blog1 year agoIndia’s Electric Vehicle Market Forecast to 2028 A Rapidly Growing Industry

-

Blog2 years ago

Blog2 years agoTop 5 best electric vehicles Under $30,000: Affordable Choices for 2024

-

Blog2 years ago

Blog2 years agoTop 10 Electric Vehicles of 2024: A Comprehensive Guide

-

Blog4 months ago

Blog4 months agoMahindra XEV 9e Launch in November Coming – Detailed Guide

-

EV news1 year ago

EV news1 year agoAmpere Magnus Neo Another Time of Electric Portability